What Does It Mean When A Bank Holds Funds . bank account holds, also known as a “funds hold” or “deposit hold,” is when a bank temporarily restricts access to some. Learn why it happens, what laws protect you, and how to get your money. why do banks place holds on checks? banks place holds on checks to make sure the payer has the bank funds necessary for the check to clear and to. a banking account hold is a temporary restriction on funds availability designed to prevent the bank and account. a check hold is the maximum number of days that a bank can legally hold the money from a check that's been. account holds are temporary restrictions placed on bank accounts, limiting access to funds and transactions. The most common reason banks put a hold on funds in your account is to. banks can hold funds after a deposit, leaving you unable to use them.

from agicap.com

a banking account hold is a temporary restriction on funds availability designed to prevent the bank and account. banks can hold funds after a deposit, leaving you unable to use them. a check hold is the maximum number of days that a bank can legally hold the money from a check that's been. why do banks place holds on checks? Learn why it happens, what laws protect you, and how to get your money. account holds are temporary restrictions placed on bank accounts, limiting access to funds and transactions. The most common reason banks put a hold on funds in your account is to. banks place holds on checks to make sure the payer has the bank funds necessary for the check to clear and to. bank account holds, also known as a “funds hold” or “deposit hold,” is when a bank temporarily restricts access to some.

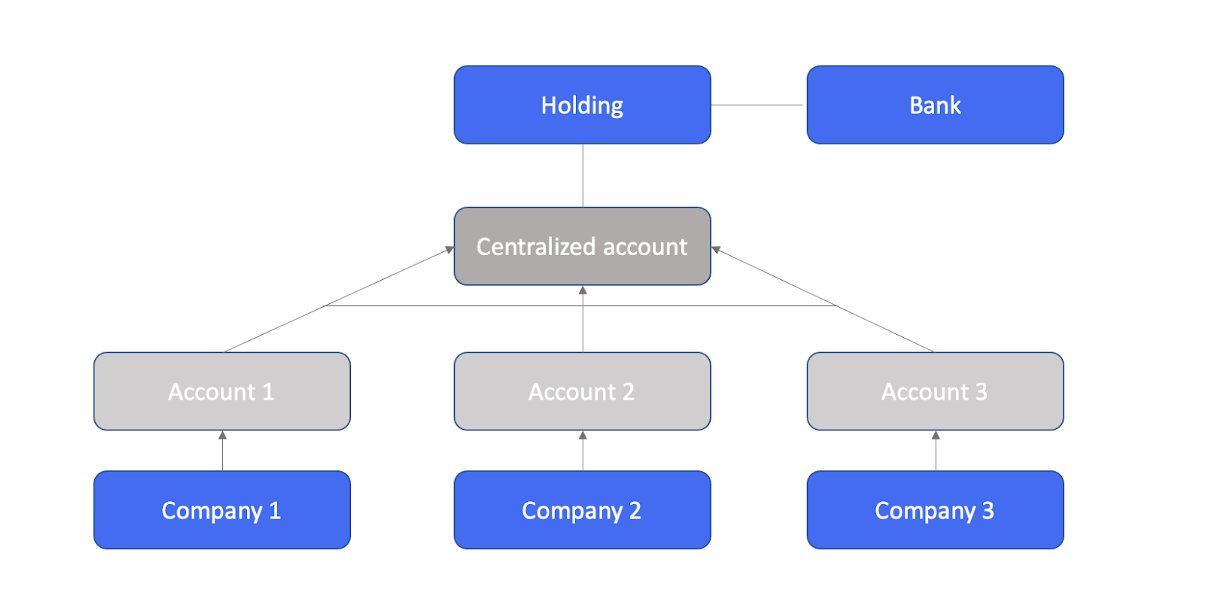

All about Cash Pooling Definition, Method, Advantages Agicap

What Does It Mean When A Bank Holds Funds a check hold is the maximum number of days that a bank can legally hold the money from a check that's been. a banking account hold is a temporary restriction on funds availability designed to prevent the bank and account. banks can hold funds after a deposit, leaving you unable to use them. The most common reason banks put a hold on funds in your account is to. banks place holds on checks to make sure the payer has the bank funds necessary for the check to clear and to. why do banks place holds on checks? account holds are temporary restrictions placed on bank accounts, limiting access to funds and transactions. bank account holds, also known as a “funds hold” or “deposit hold,” is when a bank temporarily restricts access to some. a check hold is the maximum number of days that a bank can legally hold the money from a check that's been. Learn why it happens, what laws protect you, and how to get your money.

From www.gobankingrates.com

Cashier's Check vs. Certified Check Which Is Better? GOBankingRates What Does It Mean When A Bank Holds Funds banks place holds on checks to make sure the payer has the bank funds necessary for the check to clear and to. account holds are temporary restrictions placed on bank accounts, limiting access to funds and transactions. why do banks place holds on checks? a banking account hold is a temporary restriction on funds availability designed. What Does It Mean When A Bank Holds Funds.

From www.wintwealth.com

Equity Mutual Funds Definition, Types, Benefits, Returns & Taxation Policy What Does It Mean When A Bank Holds Funds a banking account hold is a temporary restriction on funds availability designed to prevent the bank and account. banks place holds on checks to make sure the payer has the bank funds necessary for the check to clear and to. why do banks place holds on checks? The most common reason banks put a hold on funds. What Does It Mean When A Bank Holds Funds.

From www.typecalendar.com

Free Printable Proof Of Funds Letter Templates [Word, PDF] Sample What Does It Mean When A Bank Holds Funds a banking account hold is a temporary restriction on funds availability designed to prevent the bank and account. bank account holds, also known as a “funds hold” or “deposit hold,” is when a bank temporarily restricts access to some. account holds are temporary restrictions placed on bank accounts, limiting access to funds and transactions. The most common. What Does It Mean When A Bank Holds Funds.

From www.opensourcetext.org

9+ Proof of Funds Letter Template Download [Word, PDF] What Does It Mean When A Bank Holds Funds Learn why it happens, what laws protect you, and how to get your money. account holds are temporary restrictions placed on bank accounts, limiting access to funds and transactions. The most common reason banks put a hold on funds in your account is to. a check hold is the maximum number of days that a bank can legally. What Does It Mean When A Bank Holds Funds.

From www.financestrategists.com

Trust Fund Meaning, Types, Pros, Cons, & How to Set One Up What Does It Mean When A Bank Holds Funds bank account holds, also known as a “funds hold” or “deposit hold,” is when a bank temporarily restricts access to some. a banking account hold is a temporary restriction on funds availability designed to prevent the bank and account. banks place holds on checks to make sure the payer has the bank funds necessary for the check. What Does It Mean When A Bank Holds Funds.

From www.pinterest.ph

Having multiple bank accounts can dramatically increase the progress What Does It Mean When A Bank Holds Funds bank account holds, also known as a “funds hold” or “deposit hold,” is when a bank temporarily restricts access to some. a check hold is the maximum number of days that a bank can legally hold the money from a check that's been. account holds are temporary restrictions placed on bank accounts, limiting access to funds and. What Does It Mean When A Bank Holds Funds.

From paymentproof2020.blogspot.com

Proof Of Funds Letter From Bank payment proof 2020 What Does It Mean When A Bank Holds Funds a banking account hold is a temporary restriction on funds availability designed to prevent the bank and account. banks can hold funds after a deposit, leaving you unable to use them. banks place holds on checks to make sure the payer has the bank funds necessary for the check to clear and to. why do banks. What Does It Mean When A Bank Holds Funds.

From www.geekinstructor.com

How to Transfer Money Between Your Own Bank Accounts What Does It Mean When A Bank Holds Funds account holds are temporary restrictions placed on bank accounts, limiting access to funds and transactions. bank account holds, also known as a “funds hold” or “deposit hold,” is when a bank temporarily restricts access to some. Learn why it happens, what laws protect you, and how to get your money. banks place holds on checks to make. What Does It Mean When A Bank Holds Funds.

From www.youtube.com

Request Letter To Bank For Proof Of Funds Sample Letter to Bank What Does It Mean When A Bank Holds Funds account holds are temporary restrictions placed on bank accounts, limiting access to funds and transactions. banks place holds on checks to make sure the payer has the bank funds necessary for the check to clear and to. a banking account hold is a temporary restriction on funds availability designed to prevent the bank and account. a. What Does It Mean When A Bank Holds Funds.

From www.rocketremit.com

How long does a bank transfer take? Rocket Remit What Does It Mean When A Bank Holds Funds The most common reason banks put a hold on funds in your account is to. why do banks place holds on checks? banks can hold funds after a deposit, leaving you unable to use them. banks place holds on checks to make sure the payer has the bank funds necessary for the check to clear and to.. What Does It Mean When A Bank Holds Funds.

From www.iedunote.com

Bank Funds Sources, Functions, Use of Bank Funds What Does It Mean When A Bank Holds Funds a banking account hold is a temporary restriction on funds availability designed to prevent the bank and account. banks place holds on checks to make sure the payer has the bank funds necessary for the check to clear and to. a check hold is the maximum number of days that a bank can legally hold the money. What Does It Mean When A Bank Holds Funds.

From www.mygovcost.org

Here’s the overall summary of the data presented in the chart What Does It Mean When A Bank Holds Funds a check hold is the maximum number of days that a bank can legally hold the money from a check that's been. banks place holds on checks to make sure the payer has the bank funds necessary for the check to clear and to. bank account holds, also known as a “funds hold” or “deposit hold,” is. What Does It Mean When A Bank Holds Funds.

From www.coursehero.com

[Solved] Draw a correctly labeled loanable funds graph that shows what What Does It Mean When A Bank Holds Funds a check hold is the maximum number of days that a bank can legally hold the money from a check that's been. banks place holds on checks to make sure the payer has the bank funds necessary for the check to clear and to. account holds are temporary restrictions placed on bank accounts, limiting access to funds. What Does It Mean When A Bank Holds Funds.

From consumerist.com

My Bank Overdrafted My Account By Putting Two Holds On One Deposit What Does It Mean When A Bank Holds Funds banks can hold funds after a deposit, leaving you unable to use them. Learn why it happens, what laws protect you, and how to get your money. bank account holds, also known as a “funds hold” or “deposit hold,” is when a bank temporarily restricts access to some. a banking account hold is a temporary restriction on. What Does It Mean When A Bank Holds Funds.

From www.paisabazaar.com

FD vs Debt Mutual Funds Which is Better? What Does It Mean When A Bank Holds Funds banks can hold funds after a deposit, leaving you unable to use them. a banking account hold is a temporary restriction on funds availability designed to prevent the bank and account. a check hold is the maximum number of days that a bank can legally hold the money from a check that's been. The most common reason. What Does It Mean When A Bank Holds Funds.

From livewell.com

When Does The IRS Withdraw Funds From Bank Account? LiveWell What Does It Mean When A Bank Holds Funds a check hold is the maximum number of days that a bank can legally hold the money from a check that's been. bank account holds, also known as a “funds hold” or “deposit hold,” is when a bank temporarily restricts access to some. banks place holds on checks to make sure the payer has the bank funds. What Does It Mean When A Bank Holds Funds.

From agicap.com

All about Cash Pooling Definition, Method, Advantages Agicap What Does It Mean When A Bank Holds Funds a banking account hold is a temporary restriction on funds availability designed to prevent the bank and account. a check hold is the maximum number of days that a bank can legally hold the money from a check that's been. why do banks place holds on checks? banks can hold funds after a deposit, leaving you. What Does It Mean When A Bank Holds Funds.

From www.chegg.com

Solved 13) Suppose that from a new checkable deposit, First What Does It Mean When A Bank Holds Funds bank account holds, also known as a “funds hold” or “deposit hold,” is when a bank temporarily restricts access to some. a check hold is the maximum number of days that a bank can legally hold the money from a check that's been. banks place holds on checks to make sure the payer has the bank funds. What Does It Mean When A Bank Holds Funds.